Too often I have spoken with investors who want to understand how their portfolios are allocated, how they are performing, if they should make any adjustments, and how they are doing amongst their peers. Now while each of these points are important I feel these investors are looking at the proverbial trees instead of the forest. In the thousands of conversations I have had over my tenure as a financial planner, the topic of investments tends to be centered around the performance of their portfolio instead of how their performance is affecting their plan. Fifteen years of experience tells me these investors are asking the wrong question, and focusing on a piece of a bigger question. So then what’s the question they should be asking? In this article we will focus on answering “the right question” and why reframing the question can save you, the investor, time and frustration.

The Right Question

Asking the right questions is an essential responsibility for every financial professional if they intend to make a difference in their client’s lives. Every financial planner can say there is at least one question they ask every future client that reframes how the client should think about a specific topic. Unfortunately it is a combination of experience, time, mistakes, and triumphs that allow some of the best advisors to craft some of the best questions.

So what is the right question every financial professional should ask their clients that will teach them to look at the forest instead of the trees? The question I ask every person I meet with at the beginning of our financial planning journey is:

“What do you need your portfolio to do in order to accomplish your financial hopes and dreams while at the same time eliminating your fears and nightmares?”

This type of question forces an investor to focus on the end game and the steps that are needed to work towards the intended results. Furthermore, this one question actually asks three separate questions that many of my clients have never really contemplated. Let’s dissect the question to better understand the importance and application to your situation.

First the question asks you “What do you need your portfolio to do…?” This implies that you know what your portfolio’s growth target needs to be year over year as you work towards your goals. Additionally, this part of the question also implies you know the end point of where your portfolio needs to be by a particular date in the future. Now that doesn’t mean you need to be Marty McFly and hop in your DeLorean so you can travel to the future. Instead you need to outline all of your income, expenses, assets, and liabilities today and project into the future, based on today’s lifestyle, the outcome you want to pursue.

Second, the question goes on to ask about your hopes and dreams. This is a little more esoteric and requires many people to think outside the box, maybe even WAY outside the box. Regardless if you are the person who has only been in the work for a few years, or has amassed a stellar 30 year resume, this portion of the question attempts to push you to think about your future. Why are you working so hard? What are you trying to accomplish? Where do you want to be in 10, 20, or 30 years? The more you can answer this portion of the question the easier it will be to understand how to align your portfolio’s investment structure and target return.

Lastly, the final portion of the question attempts to find out about your financial fears and nightmares. It is not enough to say “I do not want to lose money”. No one does! If you are going to overcome any adversity or anxiety associated with your financial fears, then you need to fully understand them. What would cause them to occur? What would happen to you, or the family, if they did occur? If these nightmares keep you up at night then why haven’t you done anything to address them? Each one of these follow-up questions helps frame the original question because they attempt to answer your what would happen if your portfolio did not meet your expectations. For example, some investors worry about not retiring until after 70. While other investors worry about running out of money. If either of these investors do not know their required growth rate, withdrawal rate, and tax rates that will dramatically affect their overall outcome, then how can they build an investment strategy? That would be like wanting to take a cross country trip but not packing the right supplies, mapping out an intended route, and making sure they have enough money to make it all the way to their destination.

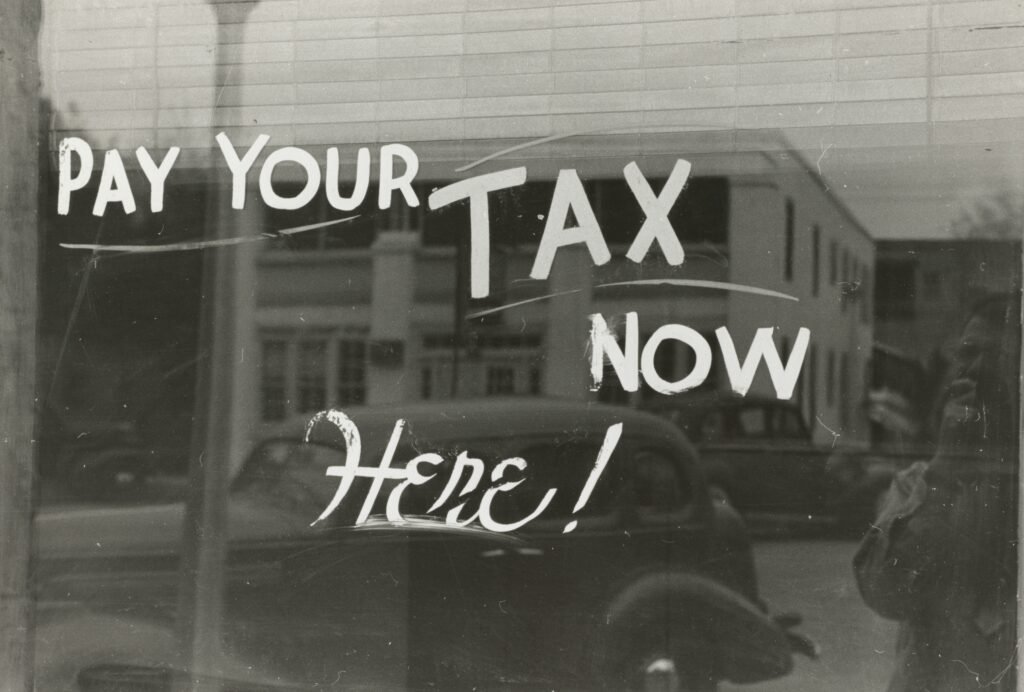

The Tax Man

Run. Run. Run. As fast as you can. Don’t get caught by the tax man! All kidding aside, many investors do not realize their portfolio’s performance is directly impacted by how much the Internal Revenue Service (IRS) takes from your investment account. In other words, the investments you select for a portfolio can be subject to different types of taxes such as capital gains tax and ordinary income tax.

Of course the tax you incur depends on the type of investment account you use. For investors who primarily use tax-deferral investment accounts, such as traditional IRAs and employer-sponsored retirement plans, then all growth within those portfolios is not taxable to the investor until the time they withdraw the funds. At the time of withdraw the deferred growth is usually taxable at ordinary income rates (also known as your income tax rate). In some cases the contributions may or may not be taxable upon withdraw. That is dependent of if you received a tax deduction when they were originally invested. On the other hand, if you invest in traditional brokerage accounts that are not subject to tax deferral, then you are subject to both capital gains tax rates and potentially ordinary income tax rates (depending on the investments used).

So why is all of this important? Before you can completely answer the question I posed earlier, you need to also think about the tax impact on the decisions you make within your portfolio. For example, if after outlining your goals you realize you only need a 50% equity and 50% fixed income strategy, then which accounts should you hold your fixed income in? Without proper planning you may think your “gross” return is keeping you on the right track toward pursuing your goals, but the hidden fact that you might be giving up 1-2% of your gross return to the tax man could make your nightmares much more of a possibility.

Conclusion

There is never one question that solves everyone’s problems. In fact, as I have learned from working with thousands of people, financial planning and investment management is a process. It requires financial professionals to ask as many thought provoking questions as they can AND then help the client assess the answers. From there, the planner and client can come to a more concrete outline of the steps needed to pursue the investor’s goals, how to overcome certain obstacles, and how to develop a detailed investment management process and strategy.

Content in this material is for general information purposes only and not intended to provide specific advice or recommendations for any individual.

Investing involves risks including loss of principal. No strategy assures success or protects against loss of principal.

There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.