I used to work for a couple of the “big box” investment firms, where one was touted for their investment research and trading capabilities while the other for their dedication to being everything to everyone in their niche market. At the time this article was written both believed financial planning should be free to their target audiences, however for different reasons.

The first viewed it as an “add-on” to their investment management services yet they limited the breadth and depth of what they could actually advise on. The second felt comprehensive financial planning was essential to protecting their clients, yet believed the “high power” planning tools should be eligible to the elite and available to those with a certain asset level. Furthermore, I believe neither firm provided a true comprehensive picture to address the risks beyond investments, life insurance, and occasionally long term care insurance.

Ultimately these constructs led to an inherent question. Is it better to pay an independent financial planner for a comprehensive financial plan or have your investment fees cover the cost of a semi-comprehensive financial plan? Let’s dig deeper…

Acknowledge The Problem

Financial Planning can be a confusing term that can evoke similar emotions of going to the dentist. Everyone knows they need to go in for the semi-annual, or maybe annual, check-up but yet few make the time to do it. Why? Inertia and Discomfort. Just like going to the gym, the first step is always the hardest and if you, or your personal trainer, are not invested in doing the work then your results will be disappointing. So where do you begin?

Step 1. Acknowledge there could be a problem.

Step 2. Realize you are not supposed to be an expert in everything and you may need to find someone to turn to in your time of need.

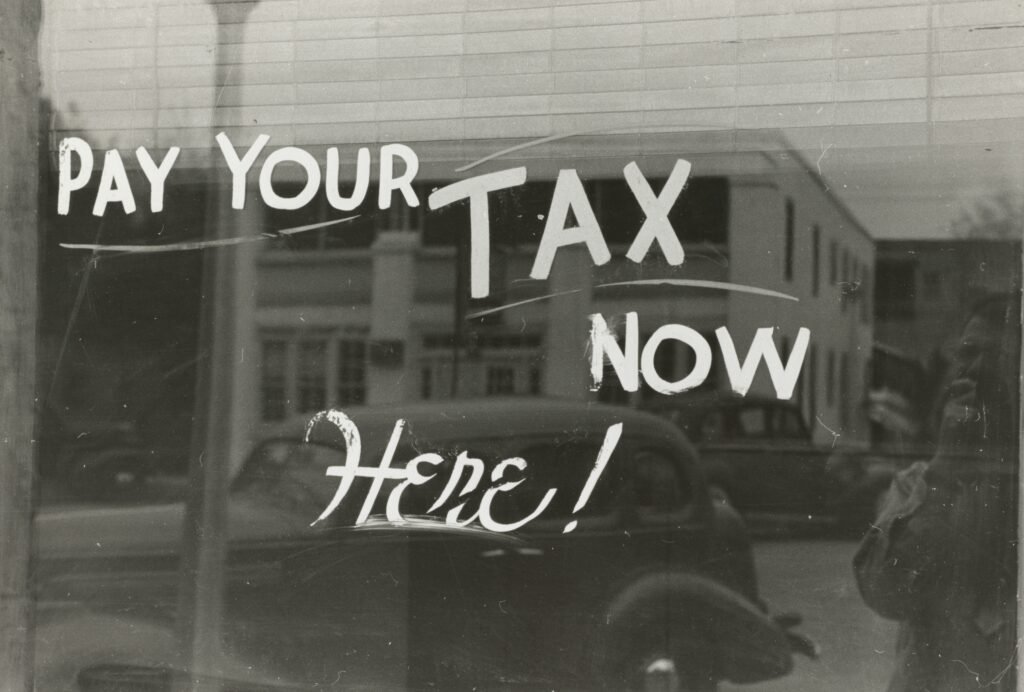

During your research phase be careful not to fall into a common trap. Many people like to ease into new adventures and usually lean toward “FREE” when testing the waters. However, have you ever heard the saying “You get what you pay for”? While not always applicable, how many of you would go to a dentist whose main practice is to give out free root canals or to a doctor willing to do free transplants? What kind of quality of work would you expect from them? Today investment firms are no different. They have commoditized investment services and financial planning to the point where they have bundled them into a package making it difficult for investors to differentiate between the value provided from one firm to the next. So whose fault is it? The fault lies with both the financial services industry and the consuming public. It is the industry’s fault for designing a mouse trap that keeps investors complacent and it is the consuming public’s fault for being complacent.

Step 3. Challenge the complacency of the status quo.

When did complacency ever get rid of that extra holiday weight?

In a world where investment and insurance companies talk about ways to “increase share of wallet” instead of ways to help you reach your goals, how do you decide who to trust? This is why when they dangle “FREE” financial planning services they charge higher rates for other services. In magic this is called the “slight of hand”. If they can find a way to pry themselves into your financial life and learn everything there is to know about you then they can figure out how to capture a larger “share of your wallet”, even if it doesn’t keep more money in your wallet.

Trust. Integrity. Transparency.

What is hard to build but easy to lose? Trust. It doesn’t matter if it’s with your friends, family, co-workers, or even your financial planner – trust is the building block in which each relationship is forged. However, how much trust can you have in a company or a person that only looks at one part of your overall life? Do you go to your accountant, or use a tax planning software, and have them only file your 1040? Maybe…but in order to know what to file the person, or tool, has to ask you a lot of questions about an assortment of topics in order to ascertain your entire situation before being able to make an appropriate recommendation on how to proceed. If you have never received an audit letter in the mail from the IRS, be glad.

Does the same logic apply to your future? To have an advisor or planner look at just your retirement picture, or maybe retirement and estate planning, seems very short-sighted. Did they determine the tax impact on your investment returns by holding certain investments in one account versus another? What about how to prioritize where your excess cash flow should go since, in the real world, you have more than just one financial goal? There are so many competing issues that when left out from the bigger picture the short-sightedness can cause harm to your long-term plan.

You might be thinking, “You used to work for these large institutions, did you treat your clients in a similar fashion?” The simple answer, No. I have integrity! If the tools or resources within an investment firm are not “robust” enough to address the vast issues affecting clients it does not mean the financial planner shouldn’t aid (as best they can) in addressing all of their client’s concerns. The moment we, as planners, sacrifice our integrity is the moment we lose our client’s trust which in turn leads to losing so much more. Does that mean every client is going to need advice or guidance on every topic? No. What it does mean is your planner should be walking you through a methodical process of addressing the many integrated issues that will affect the outcome of reaching your goals that extends far beyond the investment performance of your portfolio. This is where the difference between working with an investment advisor, financial planner, financial consultant, and a Certified Financial Planner practitioner can make a big difference. No, that is not a plug for the Certified Financial Planner Board of Standards. While each may be licensed in their own way, the Certified Financial Planner practitioner is educated on a larger body of knowledge (i.e. Retirement, Tax, Investments, Insurance, Estate), and is required to obtain ongoing continuing education requirements to stay on top of industry changes. Additionally, the Certified Financial Planner practitioner adopts the CFP Board Code of Ethics requiring them to act in a fiduciary capacity or in other words, to put their client’s interests above their own.

Inevitably the conversation comes back around to value and the fee someone is willing to pay for the value they think they will receive. How transparent do you want your investment firm to be with you? If one investment firm charges a higher asset management fee and throws in some retirement planning or asset projections, does it mean tax, estate, insurance, and other issues are not important? To be able to evaluate and pay for services independent from one another, receive a high level of quality advice, build a long trusting relationship with a person or firm, and know your best interests are being looked out for above someone else’s could be quite valuable. How much would you pay for transparency?

To Pay or Not To Pay

Throughout everyone’s decision process there are a few key questions to keep in mind.

- What are you good at in life? Does that extend to investments and financial planning?

- Are you willing to stake your financial future on your skills?

- Can your spouse, or partner, follow in your footsteps when you are gone?

- If you cannot manage your financial affairs today, who do you turn to in your time of need?

- Do you want someone looking at all aspects of your financial life or just a few?

- How much is a roadmap of your financial future worth to you?

A client once told me, “You should never pay for something you can do yourself” and I agreed with him. I followed it up with “If any of my clients have the skill, will, and time to do what I have spent fifteen years learning how to do, they should”. To which he responded “I cannot do this, but even if I could I wouldn’t want to”.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. Investing involves risk including loss of principal. No strategy assures success or protects against loss.