Exiting a business does not have to be difficult. In fact, exiting a business can be pretty straightforward if you understand the elements that are required to prepare, market, and exit a business correctly. Unfortunately, we get lulled into a false sense of security based on the cash flows our business creates and the value we believe we are imparting on our clients. After enough time we, as business owners, feel that our business is shaping the world one client at a time and it is under our leadership that the company’s value should be at its peak. This is one example of the mistakes that business owners fall victim to when considering whether to exit a business. In this article we will cover the top five (5) mistakes business owners face and the damage each mistake can have on the exit price.

Mistake 1: I’ll exit when I am ready to retire

If it was easy to simply “exit and retire” every business owner listed on every business brokerage website would have already sold their business and sailed off into the sunset. Unfortunately, as many of them have come to realize, that is truly a fallacy. The idea that you can wake up one day and tell yourself “let’s go do something else” is incorrect.

What’s worse is when the date of sale is outside of your control. For example, if you woke up tomorrow and were not able to perform the duties that you are supposed to do to keep the business running you would be forced into exiting your business. This forced “fire sale” creates an opportunity for buyers to scrutinize the business in order to drive the sales price down. If your business is not in a position to weather a fire sale then you could end up with FAR LESS than what you actually need to survive.

The “exit when ready and retire” concept is a pipe dream for the vast majority of business owners. In reality, the concept should be called “exit when ready and cross my fingers”. Without proper planning, preparation, and due diligence on the seller’s part the value of their business is usually outside the realm of reality.

Mistake 2: I can do it on my own…

I am sure you are very intelligent, I mean you did build a successful business. Unfortunately, for that same reason you most likely have blinders on. In most cases, business owners do not perform a “Is my baby ugly?” test prior to putting their business on the market. Or if they do the test isn’t completed far enough in advance which means there isn’t enough time to fix the underlying issues within the business prior to sale.

In most cases you need a full team of professionals to help you. The size of your team is dependent on the size of your business. For example, a business valued between $1 million and $10 million will probably need an accountant, exit planner, financial planner, estate planner, corporate attorney, and business broker. If you exit below $1 million you can probably drop the exit planner. If you exit above $10 million you might add an investment banker and a therapist.

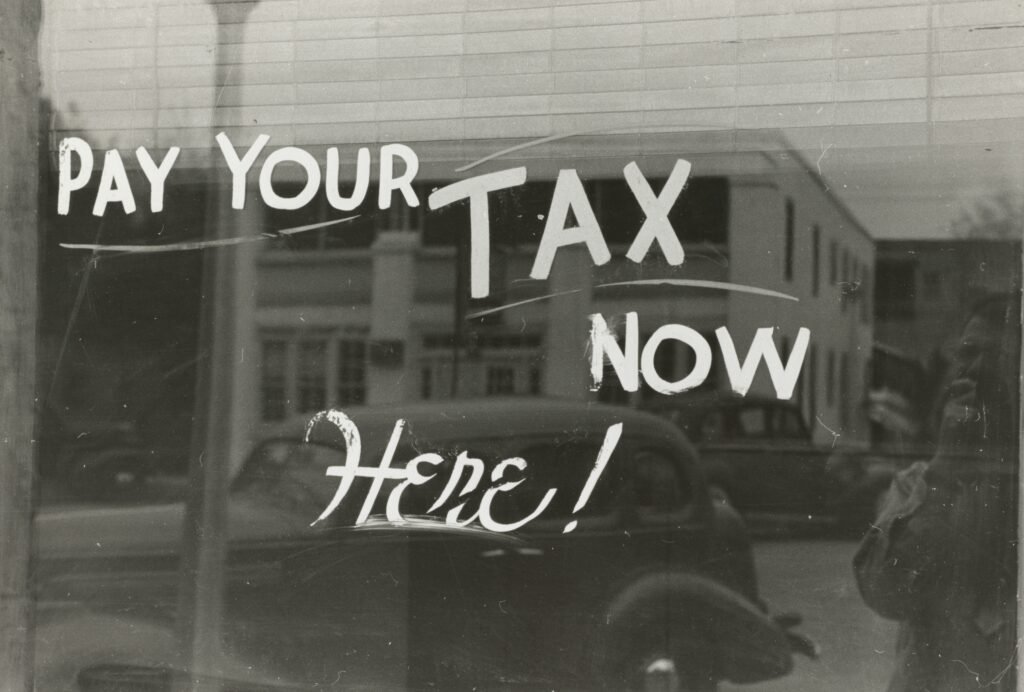

Each of the aforementioned professionals plays a specific role in helping you in a variety of areas. For example you will want to prepare the business for sale, lower your tax liability at exit, optimize the exit price, determine if you have enough money after the exit, and mentally adjust to your life after the sale.

Mistake #3: My accountant will tell me when I should sell…

I love my accountant just as much as the next business owner but in all fairness to them they have NO CLUE when I should sell my business. There are so many factors to take into consideration, not the least of which…you have to WANT to sell. If most business owners do not know when they want to sell how will their accountant know when they should sell?

This is not to say accountants are not great at their job. Most are very good at their job. However, their job usually starts and ends at tax preparation, tax strategy, maybe corporate structuring, and potentially business valuation. However, the last one is usually a specialty and it is something you would ask them to perform for you every three to five years…

Once you know when you are ready to retire, or sell, then you can ask your accountant whether they perform business valuations, and if so to complete an official valuation. If they do not perform valuations you can reach out to certified valuation experts like exit planners and valuation analysts. Although once the valuation is complete you will need to bring other members of your team (mentioned in Mistake #2) to help address other issues outside the valuation.

Mistake #4: I know the value of my business…

Every business owner thinks they know the value of their business. Why wouldn’t we? We are in the trenches! We know where the skeletons are, we know the progress we made from the start, and we know the opportunities ahead of us. Each of the aforementioned reasons are the EXACT reasons you probably have no idea the true value of your business.

I am sure you have heard the phrase “rose colored glasses”. That is exactly how most business owners look at their business. The emotions invested into the business over the years leading up to sale are often considered an unspoken premium most business owners add on top the actual value. Unfortunately, buyers do not want to pay the “emotions” tax. This is when hiring outside professionals to value, or evaluate, the strengths and weaknesses of your business is crucial. They will help shed light on how much emotional tax the business owner is including in their exit price.

Now, I do not want to make it seem as though the seller’s price is completely unrealistic. Some businesses are actually worth the amount the seller is asking for but those circumstances are not the norm. In this situation the business owner has invested as significant amount of time and energy into preparing the business for sale. This means they have cleaned up a number of items within the following categories: marketing, planning, finance, legal, leadership, people, sales, and operations. When a buyer looks at a business as a well oiled machine they know their investment will come back to them within three to five years, if not sooner. When businesses are not correctly prepared for sale the buyer gets worried and discounts the purchase price. They think there is some amount of work that is needed in one of the previously listed categories and they are worried the cost to fix/repair/improve that category will be sizable. This leads me to say, if you knew the deficiencies prior to sale then you would have fixed them… and most business owners cannot see the forest from the trees.

Mistake #5: Valuation methodologies are all the same…

It would make life a lot simpler if all businesses were valued the same way. Although asset based businesses would be at a disadvantage to equity businesses and, potentially, vice versa. This is one reason why there are a number of different valuation methodologies. In fact, depending on the type of business you own, obtaining different valuations (i.e. discounted cash flow, multiples, or asset based) with different values could be a benefit to you. Knowing the range your buyer may offer can be used as a tool in your negotiation.

Conclusion

Just when we believe we know the elements needed to sell our business we realize we do not know enough. This is why hiring qualified professionals like exit planners, financial planners, accountants, and business brokers – or investment bankers – is critical. Only when you are prepared for “battle” can you enter the negotiation process with the stronger hand. If you need help building your exit planning team to sell your business we strongly encourage you to reach out to our team of financial planners and exit planners. Our team at C-Suite Planning™ can help you construct your executive financial plan AND work with your team on constructing your exit plan!

The material contained in this article was created for educational and informational purposes only and is not intended to provide specific recommendations, tax, or legal advice. The author, and the author’s firm, strongly encourages you to speak with a qualified professional before taking action on anything mentioned in this article.